How Do Mature ESOPs Provide for New Employees? Rebalancing…

Part Four of our Sustainable ESOP Series

Last week in this blog, we explained that a sustainable ESOP will ensure that future employees will benefit from the ESOP in a manner similar to those employees that benefit when the ESOP is first implemented. To do so, the length of the Internal Loan should be determined with an eye toward sustainable benefit levels and benefits for future employees.

Nevertheless, even if you extend the Inside Loan, there will be a time when no loan exists and all shares formerly held in the suspense account will be allocated to participants. While the company may continue to make contributions to the plan, little stock is likely to be available to new participants. In that case, it may be difficult to continue cultivating a culture of employee ownership when a number of employees will not have meaningful ownership in the company.

Rebalancing

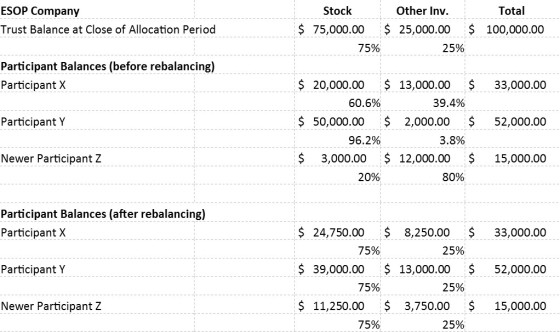

One way that mature companies address this issue is through rebalancing. Rebalancing is a plan provision and has been defined by the Internal Revenue Service as “the mandatory transfer of [company stock] into and out of participant ESOP accounts, usually on an annual basis, designed to result in all participant accounts have the same proportion of [company stock].”

Under a rebalancing provision in an ESOP, each participant will have the same percentage of stock and other investments as any other participant even though their total account balance amounts will differ. In operation, cash contributions are allocated to each participant under the normal terms of the plan (e.g., based on the ratio of the participant’s compensation in relation to overall compensation). Then, participants who do not have stock in their accounts (or the same amount as others) will use the cash contribution allocated to them to “purchase” the stock within the plan from participants that do have stock in their accounts. These stock “purchases” occur until each participant has the same ratio of stock to other investments as every other participant.

Illustration

As demonstrated in the Illustration, Newer Participant Z has a much smaller percentage of company stock than his counterparts Participants X and Y before rebalancing occurs. Because of rebalancing, Newer Participant Z gets more stock and thereby a greater chance to participate in “ownership” of the employer. The same is true for Participant X, albeit to a lesser extent. Participant Y, on the other hand, reduces his investment in company stock. But Participant Y does get some additional diversification of his investments in the plan. As shown, rebalancing helps newer participants get company stock and this, in turn, facilitates the implementation of an employee owner culture. And the longer-tenured participants get additional diversification.

Implement Rebalancing Early On

The greatest difficulty of implementing rebalancing with a mature ESOP is that the longer-tenured participants do not want to be “diversified” out of company stock. That is especially true where the company is growing and the FMV of the company stock is outpacing other investments. Some of these longer-tenured participants feel that their benefit is being reduced, even though as a legal matter, the benefit remains the same. It is only the investment mix that changes. To prevent this “stock entitlement” issue in the mature ESOP, we recommend including a rebalancing provision at the time of establishment. Even though the rebalancing will not occur early on (as stock is being released from the suspense account), establishing rebalancing from the outset conditions expectations of the participants. It is easier to explain early on that rebalancing will occur to ensure that all participants get to benefit from company stock rather than after older participants get comfortable that they will have the stock as an investment in perpetuity.