ESOP 101: The What/Why/How

The following video provides an overview of the many benefits that ESOPs can provide to retiring owners and future employees.

The following video provides an overview of the many benefits that ESOPs can provide to retiring owners and future employees.

Last week in this blog, we explained that a sustainable ESOP will ensure that future employees will benefit from the ESOP in a manner similar to those employees that benefit when the ESOP is first implemented. To do so, the length of the Internal Loan should be determined with an eye toward sustainable benefit levels and benefits for future employees.

Nevertheless, even if you extend the Inside Loan, there will be a time when no loan exists and all shares formerly held in the suspense account will be allocated to participants. While the company may continue to make contributions to the plan, little stock is likely to be available to new participants. In that case, it may be difficult to continue cultivating a culture of employee ownership when a number of employees will not have meaningful ownership in the company.

Rebalancing

One way that mature companies address this issue is through rebalancing. Rebalancing is a plan provision and has been defined by the Internal Revenue Service as “the mandatory transfer of [company stock] into and out of participant ESOP accounts, usually on an annual basis, designed to result in all participant accounts have the same proportion of [company stock].”

Under a rebalancing provision in an ESOP, each participant will have the same percentage of stock and other investments as any other participant even though their total account balance amounts will differ. In operation, cash contributions are allocated to each participant under the normal terms of the plan (e.g., based on the ratio of the participant’s compensation in relation to overall compensation). Then, participants who do not have stock in their accounts (or the same amount as others) will use the cash contribution allocated to them to “purchase” the stock within the plan from participants that do have stock in their accounts. These stock “purchases” occur until each participant has the same ratio of stock to other investments as every other participant.

Illustration

As demonstrated in the Illustration, Newer Participant Z has a much smaller percentage of company stock than his counterparts Participants X and Y before rebalancing occurs. Because of rebalancing, Newer Participant Z gets more stock and thereby a greater chance to participate in “ownership” of the employer. The same is true for Participant X, albeit to a lesser extent. Participant Y, on the other hand, reduces his investment in company stock. But Participant Y does get some additional diversification of his investments in the plan. As shown, rebalancing helps newer participants get company stock and this, in turn, facilitates the implementation of an employee owner culture. And the longer-tenured participants get additional diversification.

Implement Rebalancing Early On

The greatest difficulty of implementing rebalancing with a mature ESOP is that the longer-tenured participants do not want to be “diversified” out of company stock. That is especially true where the company is growing and the FMV of the company stock is outpacing other investments. Some of these longer-tenured participants feel that their benefit is being reduced, even though as a legal matter, the benefit remains the same. It is only the investment mix that changes. To prevent this “stock entitlement” issue in the mature ESOP, we recommend including a rebalancing provision at the time of establishment. Even though the rebalancing will not occur early on (as stock is being released from the suspense account), establishing rebalancing from the outset conditions expectations of the participants. It is easier to explain early on that rebalancing will occur to ensure that all participants get to benefit from company stock rather than after older participants get comfortable that they will have the stock as an investment in perpetuity.

As noted in the two previous entries in this four part series (you can find part one here and part two here), addressing fair market value and debt capacity at the outset in the transaction structure is key to developing a sustainable ESOP. Also important, consideration should be given to the long-term impact of the ESOP and the liability that arises in the form of repurchase obligation. The terms of the Internal Loan (i.e., the loan between the Sponsor and the ESOP) should be structured with some consideration of the long-term liability of the repurchase obligation.

While the repurchase obligation will be affected by the timing of participant retirements and termination of service and the growth in the value of the ESOP’s stock, the Sponsor has the ability to address and plan for meeting its repurchase obligation by designing the Internal Loan to have a longer duration. Because the stock purchased by the ESOP with the proceeds of the Internal Loan is held in a suspense account and only released and allocated to participants over the term of the Internal Loan, the longer the duration of the Internal Loan, the fewer shares allocated to the participants in each year. Thus, if participants die, retire, terminate employment or exercise diversification rights prior to the repayment of the Internal Loan, the more manageable may be the satisfaction of the repurchase obligation.

When only corporations taxed under subchapter C could sponsor ESOPs, the terms of the Inside Loan, including duration, frequently would mirror the Outside Loan. This mirror loan structure originally served two purposes: (1) to ensure that the C corporation could maximize the deduction of the principal paid to the lender (deductible contributions = principal loan payments), and (2) to assist lenders in meeting the requirements of former Internal Revenue Code Section 133 (that provided the lenders an incentive to lend to an ESOP, but required that the Inside Loan mirror the Outside Loan). Now that Section 133 no longer exists and many companies sponsoring ESOPs are taxed under subchapter S of the Code (and therefore may have no need for the contribution tax deduction), the need to have the Inside Loan mirror the Outside Loan no longer remains.

Despite the fact that the need to mirror the loans has abated, many companies still do so. These companies find that the loans are paid off in 5-7 years and, consequently, all of the stock purchased with the proceeds of the Internal Loan has been allocated to the participants. Moreover, the level of contributions made to pay off these relatively short-term loans often required that the Sponsor make ESOP contributions that came perilously close to exceeding the maximum limitation on contributions to qualified plans (i.e., 25% of participant compensation). This combination of factors often lead to two results: (1) participants for the first years of the ESOP received an accelerated benefit, and (2) participants that entered the plan after the first years did not receive a similar benefit and often had very little stock allocated to their accounts (as a result of the allocation only of forfeitures and repurchases by the ESOP of shares from distributees). Many of these mature ESOPs then were forced to deal with situations where the ESOP provided benefits only to a portion of the employees (or the benefits were weighted heavily in favor of only a portion of those employees).

Some companies noticed this issue too late and sought to refinance the Inside Loan to provide for benefits to all of their employees and extend the repayment schedule. The DOL was concerned that the employees were not receiving expected benefits due to these refinancings and issued Field Assistance Bulletin 2002-1. Under the DOL’s guidance, a fiduciary considering a refinancing to extend the maturity of the Internal Loan must assess the extent to which the extension is “consistent with the reasonable expectations of the plan’s participants and beneficiaries, as might be determined by reference to the plan’s summary description or other disclosures describing the funding and benefits of the plan.” If the participants’ had been receiving an annual benefit equaling 25% of compensation for a period of time, a fiduciary might reasonably conclude that a refinancing to reduce those benefits and extend the payment over time is not consistent with the participant’s expectations. While companies’ have provided permissible inducements to the employees as a whole to refinance the Inside Loan within the boundaries of fiduciary prudence, it is no small task and is not without risk.

In light of the foregoing, we recommend that the terms of the Inside Loan, especially duration, receive substantial consideration at the outset. Two items should be considered: (1) What is a reasonable annual benefit to the employees in comparison to other employees of similarly situated companies? (2) What amount of annual benefit to participants is sustainable by the company?

As to the first consideration, one of the greatest non-tax related benefits of an ESOP is its ability to attract and retain talent. The substantial financial benefits to employees that NCEO and other ESOP organizations advertise (including these authors) are, in part, what makes ESOPs effective. However, thought should be given to the total amount of compensation and benefits made to employees as a whole when considering the proper length of an Internal Loan. The NCEO has gathered significant data on compensation paid in ESOP companies in comparison non-ESOP companies. That information can be reviewed to determine what level of benefits should be provided to employees to ensure that wages and benefits are competitive and sustainable.

The second consideration is of vital importance to the Sponsor’s ability to meet its repurchase obligation. While the repayment of the Inside Loan is not a cash drain, the loan repayment causes shares to be released from the suspense account, increasing the balances of participant accounts, and ultimately, accelerating the pace at which the company must repurchase shares to facilitate distributions.

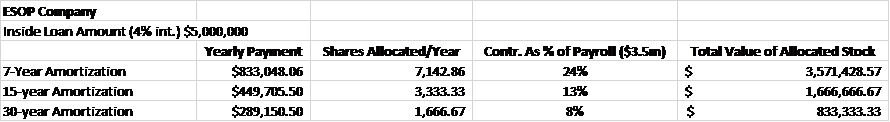

An illustration might help show the value of extending the term of the Inside Loan from the outset. In Illustration 1, an ESOP Company has an Inside Loan of $5 million at 4% interest with standard amortization. The ESOP entered the Inside Loan in the purchase of all 50,000 of the issued and outstanding shares of the company at a value of $100/share. Illustration 3 shows the yearly ESOP loan payment obligation, the number of shares allocated per year and the annual contribution as a percentage of payroll (assuming $3.5mm in payroll), under three different loan periods: 7-year, 15-year, and 30-year. Finally, also included in the Illustration is a rudimentary calculation of the total value of the allocated stock after five years assuming, for this illustration only, that the value of the stock after 5 years returns to its transaction price of $100/share.

Illustration 1

As Illustration 1 shows, the 7-year amortization results in a significantly larger value of allocated stock after five years. The 30-year loan amortization results in roughly a quarter of the value allocated to participants as allocated under the 7-year loan amortization. Note that under the 30-year loan amortization, each participant still receives, in very basic terms, an additional 8% of compensation. In terms of employee benefits, that is an excellent additional benefit. For example, research shows that non-ESOP companies generally transfer about 4% of compensation into their 401(k) plans.

Extending the Inside Loan ensures that benefits are allocated to old and new participants alike and such benefits are sustainable for the Sponsor for the long term. Too much allocation too soon can lead to a mature ESOP with an unsustainable benefit level, new participants with little ownership incentive, and ultimately, reduced benefit due to a repurchase obligation crisis.

In part four, we will offer another ESOP design option to address the “haves” and “have nots” issue that can arise in a mature ESOP. Please feel free to contact us with questions about your sustainability issues.