ESOPs Take the Oxymoron Out of Inclusive Capitalism

ESOPs Take the Oxymoron Out of “Inclusive Capitalism”

In a January 20, 2015, op-Ed piece in the New York Times, “Can Capitalists Save Capitalism”, Thomas Edsall reports that key Democrats have reached agreement on a set of policies known as “inclusive capitalism” that would reduce wealth and income inequality. According to Edsall the inclusive capitalism concept has expanded worldwide over the past 13 years to apply to those at the bottom and the middle of the ladder in developed nations, including the United States. Edsall reports that Republican leaders in Congress have already “stiff-armed” these proposals.

On May 27, 2014, more than 220 leaders met for the “Conference of Inclusive Capitalism” in London to discuss the future of capitalism and “how we can act to make our economic system more equitable, more sustainable and more inclusive.” Carol Hanish, writing in CounterPunch, a magazine that touts itself as “America’s Best Political Newsletter”, dismisses “inclusive capitalism” as an oxymoron and posits that in economics our thoughts and actions must be constrained within a discussion of “capitalism” versus “communism”.

Is there a way to bring these shrill views together? Is there a vehicle to help mitigate the media-fanned tension between the evil, exploitive others and the virtuous rest of us?

There is such a vehicle in the United States, and it is already a vibrant part of federal law. It has continuing broad-based, bi-partisan support. It helps business owners, and it rewards employees by turning them into capitalists. It distributes capitalism into smaller employee teams who can compete effectively in the global marketplace. It supports the fundamental American idea that reward follows hard work and strategic collaboration.

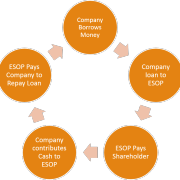

The vehicle is the Employee Stock Ownership Plan (the ”ESOP”). It is a special kind of qualified retirement plan that can borrow money to buy businesses from owners who wish to sell. The ESOP buys the seller’s business for the benefit of all the employees of the business. These employees in turn reap the rewards of their success (and, much less often, suffer from their failures), as did the prior owner. In most cases, other common retirement plans, like 401(k) plans, continue to exist in the employee owned business along side the ESOP so that the risk to employees of business failure is minimized.

ESOPs have been around for many years. Since 1974 they have been defined and regulated by the Internal Revenue Service and by the US Department of Labor for the protection of the employee owners. They offer tax benefits to selling owners as well as tax benefits to employee owners. Because ESOPs benefit both owners and ordinary employees, both US political parties have consistently supported them.

Over 50% of the US workforce works for small businesses with fewer than 500 employees. About 15 million of these employees already work for the approximately 9000 companies that have ESOPs or ESOP-like profit sharing plans. Employees of ESOP companies regularly accumulate and ultimately receive substantial cash benefits from their ownership in ESOP companies.

In the United States, it is not necessary to create dozens of new, convoluted tax and fiscal policies to produce inclusive capitalism. It is not necessary to create more bureaucratic structures to deliver fiscal benefits or to administer new taxes. It is not necessary to increase the level of sharp partisan disagreement about policy. All we need to do is increase the use of a well-defined tool that we have had in place for over 40 years.

ESOPs are the ideal synthesis between traditional capitalism and inclusive capitalism. They represent capitalism. They do not represent communism or socialism. They encourage employee owners to pool their front line knowledge competitively in the global economy. They spread the wealth among those who compete successfully, and they have the potential to reinvigorate global American business with a tool already at hand.