Is an ESOP Right for Your Business?

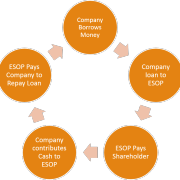

We are frequently asked whether an ESOP is right for a particular business. As a business owner reaches retirement age, the question of how to protect his legacy while exiting the business comes to the fore of his or her mind. On the one hand, an owner can sell his or her business outright. But this involves the owner immediately giving away all that they have worked for and built. An ESOP may provide a better option. In an article featured in Forbes magazine, contributor Stuart Robertson suggested five questions that will assist business owners in deciding whether an employee stock ownership plan (ESOP) is right for their business.

-

Does the company make enough money? For Robertson, an ESOP makes sense only if a company has at least 20 employees and more than $5 million in annual sales. This is because the set up costs and annual costs of running the plan can cost thousands of dollars. While the 20 employee / $5 million in sales figures are not absolute, Robinson uses these numbers as a way of highlighting the need to conduct research and/or studies before setting up an ESOP to ensure such a plan is financially feasible for the company. We suggest that net profit in the range of $1 million is a better barometer.

-

Does the owner or owners want to retain some measure of control? In a straight sale of a business, the owner or owners sell their ownership interests outright and thus lose all ownership rights in one instant. But an ESOP can allow an owner’s interests to be purchased in stages over time. For an owner who has worked for years to build the business, this gradual transition allows the owner to ease into retirement. Indeed, in most ESOP transactions, the owners remain board members and executives for some time after the close of the transaction.

-

Is the owner in a hurry to sell? If the business is profitable and the owner is in no hurry to sell (i.e., the owner has some money in reserves and is comfortable with the employees buying him or her out over a period of time), an ESOP may make sense. Conversely, if the owner is strapped for cash and requires immediate and full liquidity, an ESOP may not be a good choice.

-

Is the owner concerned about his or her tax liability? An ESOP can provide significant tax benefits, including deductibility of contributions and the deferral of capital gain on a sale of C corporation stock if proceeds are reinvested in stock of U.S. operating companies.

-

Does the owner believe in his or her employees? Companies with ESOPs generally have higher productivity levels and larger profits because employees are motivated to help the business succeed. Owners who do not trust their employees to work for the betterment of the company may not see the benefits of setting up an ESOP.

Contact a Knowledgeable ESOP Attorney

Whether you set up an ESOP for your business is a decision that can have a dramatic impact on the future of your business. Do not make this decision without consulting with us at ESOP Plus. We can help you evaluate whether an ESOP makes sense for your situation and, if it is, we can assist you in setting the plan up. Contact ESOP Plus today at (888)-840-6830.