How Do I Set Up an ESOP?

40 years ago, Employee Stock Ownership Plans (ESOP) were virtually unheard of 4. Today there are approximately 7,000 vibrant companies that have ESOPs in place, benefiting over 13 million employees. While there are many reasons why a private company may set up an ESOP, the decision process to set up an ESOP and actually setting up such a plan usually includes the same or similar steps:

Step One: Determine if the Owners and Senior Management of the Company are Agreeable

It may go without saying, but an ESOP must have the agreement and support of the business owners. The business owners must be interested in liquidity and diversification of their wealth, and importantly, interested in transitioning ownership of the company to valued employees. It is also helpful if senior management (the valued employees) supports the process.

Step Two: A Feasibility Study

If owners and management are on board, a feasibility study should be performed. The size and complexity of the business will dictate how formal of a study is necessary, but at a minimum, a ballpark estimate of value should be determined so that the owners can decide if they want to sell. Then, cash flow, payroll, and the potential repurchase obligation of the company should be examined to determine if the company can afford to fund the purchase from the current owners and meet the limitations and requirements of the Internal Revenue Code.

Step Three: Design the Plan and Structure the Transaction

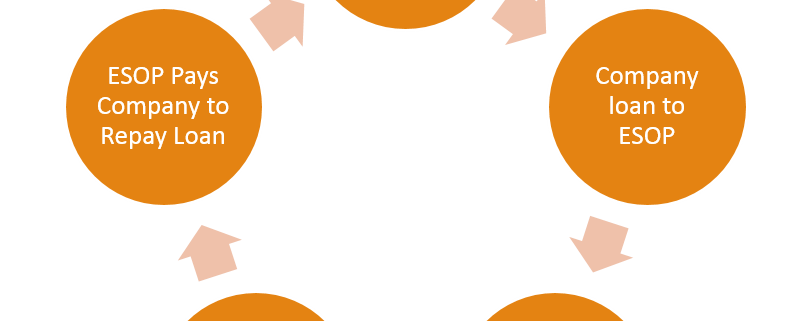

Assuming that the plan is feasible and supported by the owners and management, the next step should be to design the Plan and transaction—i.e. the sale of company stock to the ESOP. A knowledgeable ESOP attorney will draft a plan that allocates the benefit to employees in a manner acceptable to management and the IRS. Further, the knowledgeable ESOP attorney will advise as to compliance with fiduciary standards in ESOP transactions. The transaction may include bank financing, seller financing, or a combination of the two. Your ESOP attorney will assist in preparing any and all documents to ensure a smooth transaction that meets the goals of the parties and the most recent regulatory guidance. .

Step Four: Trustee Engaged and Transaction Closed

To complete any transaction, the company must engage a trustee who will act solely in the interests of the beneficiaries of the ESOP. While an employee of the company may act as trustee, it is a best practice to engage an “outside” trustee. Once the ESOP has been adopted and the transaction has occurred, the business may return to an “internal” (employee) trustee. The trustee must obtain the guidance of an independent appraiser. That appraiser will determine whether the price to be paid by the ESOP is no more than fair market value and the transaction is fair to the participants from a financial point of view.

Step Five: Carrying Out the Plan

Post-transaction activities include submitting the ESOP plan to the IRS for a determination of qualification. Your ESOP attorney will assist in this process. And like other defined contribution plans (i.e. 401(k)s), annual 5500 reporting must be completed for the ESOP. If the stock sold to the ESOP is not publicly traded, that stock must be valued on an annual basis. Not to be lost in the shuffle, employees must be educated about the ESOP and encouraged to get involved.

Contact ESOP Plus

The process of creating and carrying out an ESOP does not need to be intimidating. We can help you understand ESOPs and help you evaluate whether an ESOP makes sense for your situation. We can also guide you through the setup process and ensure your plan meets with IRS approval. Contact the ESOP Plus team today at (888) 840-6830.