2015 Employee Ownership Conference in Denver This Spring

The growing community of employee-owned companies will gather April 20-23, 2015 in downtown Denver for the 2015 Employee Ownership Conference. Hosted by the National Center for Employee Ownership (NCEO), more than 1,200 attendees representing businesses from across the U.S. will learn about emerging trends, legal issues, best management practices, and much more. The events will all be held at the Sheraton Downtown Denver conference hotel.

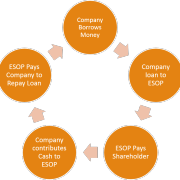

The United States presently has close to 9,000 employee ownership companies. These businesses employ over 14 million people and outperform other business in job creation and productivity, while more broadly sharing the wealth they create. Driven by the demographic wave of baby boomers entering retirement age, the number of businesses for sale is sharply increasing, and many of those owners are choosing to exit their businesses by selling to employees.

ESOP Plus®: Schatz Brown Glassman Kossow LLP is proud to be sponsoring this conference. We will be actively involved with exhibiting, speaking, and sponsoring the book provided to each participant, which will provide insight into current trends in employee ownership. Our partner Peter Jones will be presenting on Tuesday, April 21, 2015 at 10:30 a.m. on “ESOP Committee Roles: Are WE responsible for that?”

As a special sponsor benefit, we are happy to be able to offer our clients and contacts the following discount codes for registration. Simply enter the following discount codes on the registration page, when asked and you will receive $35 discount per attendee for the main conference, and a $20 discount per attendee for any preconference session.

Main Conference: Save35

Any of 3 preconference sessions: Save20

For more information and to register, go to /www.nceo.org/conference or call the NCEO at 510-208-1300. We urge interested companies to register soon, as this conference often sells out in advance!

Highlights of the conference include:

- Morning Keynote Address on Wednesday, April 22, Mary W. Tilley from W.L. Gore & Associates speaks about Cultural Practices That Drive Business Results: What Ownership Inspires

- Over 90 sessions in five learning tracks: employee stock ownership plan (ESOP) basics, ESOPs beyond the basics, compensation and benefits, communications and culture, and leadership and governance.

- On the afternoon of Monday, April 20, three half day preconference sessions, Compensation Issues for Privately Held Companies, Building a Culture of Ownership in an Employee-Owned Company and Corporate Governance at ESOP Companies.

- The Tuesday April 21 Welcome Luncheon and Opening General Session with the address, the State of Employee Ownership, by executive director Loren Rodgers.

- Numerous opportunities to network, to discuss, participate, learn, and share

- Exhibit hall with a wide representation of firms doing business in the employee ownership and equity compensation field

What Past Participants Say About This Conference:

“Networking opportunities were fantastic, especially the industry roundtables. And the energy of the group was palpable, positive, and infectious.”

“I was a first-time attendee to this conference and loved it. I hope to talk my company into sending me to this every year, no matter where it is located”

“For me, this was the most useful conference ever since I was able to find a breakout in each time slot that dealing with matters I face each business day.”

“I was amazed at how well run, informative, and professional this conference was. The quality of most of the speakers was so high that the whole event just flew by.”

The NCEO (www.nceo.org) is a nonprofit research and education organization established in 1981. It is widely recognized as the main source for accurate, unbiased information on ESOPs, other forms of equity compensation, and ownership culture. Learn more about employee ownership from the NCEO (www.nceo.org) or our informational Web site www.esopinfo.org.